E2-Block

Analysis of the Wealth Ecology Model Framework Based on Provided Diagrams

Dr. Oliver Jones,

Upon reviewing the visual representations provided, it is evident that the Wealth Ecology Model represents a multi-dimensional framework capturing the various facets of wealth creation, sustenance, and growth. Let’s delve into a comprehensive analysis:

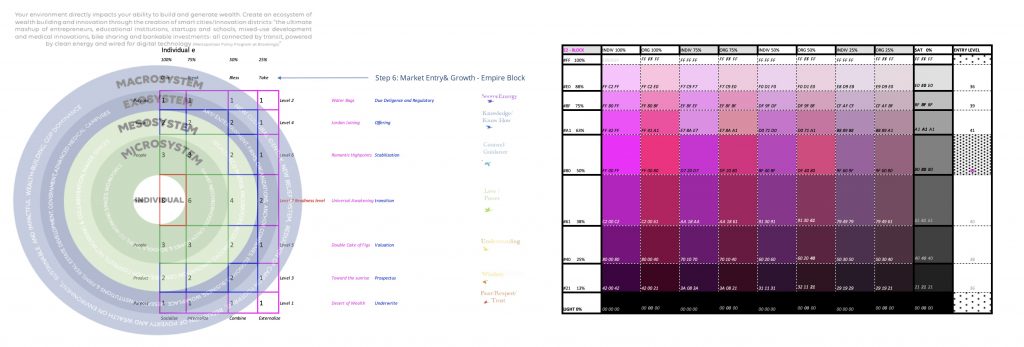

1. Ecosystemic Perspective:

On the left, the circular diagram illustrates a hierarchical progression from the individual to macro-level systems, emphasizing the interconnectedness of individual actions, community engagements, and broader socioeconomic environments.

- Individual: This core circle highlights the importance of the individual in wealth creation. Their values, mindset, and actions form the foundation upon which wealth is built.

- Microsystem: Surrounding the individual, the microsystem includes direct interactions, relationships, and immediate environments, representing perhaps family, close peers, and local communities.

- Mesosystem: Expanding outward, the mesosystem seems to embody interactions between different microsystems, suggesting collaborations between local entities, community organizations, and businesses.

- Macrosystem: As the outermost layer, the macrosystem points to broader societal and global factors that influence wealth, such as global economies, governmental policies, and cultural trends.

The gradient from “Give” to “Take” and the interplay between “Bless” and “Break” suggest a dynamic tension between contribution and consumption, emphasizing a balance is crucial for sustained wealth generation.

2. Wealth Generation & Growth Pathway:

The right side diagram appears to be a schematic representation of the journey towards wealth creation and expansion.

- Market Entry & Growth – Empire Block: It seems to delineate stages of progression in wealth creation, from foundational steps (e.g., “Desert of Wealth”) to more advanced stages like “Universal Awakening transition.”

- Guidance & Metrics: Various checkpoints like “Due Diligence and Regulatory” and “Jordan Joining” might represent crucial milestones or decision points in wealth growth. Furthermore, there’s an underlying indication of external guidance or mentorship, as seen in elements like “Counsel/Guidance” and “Love/Power.”

- Valuation & Evaluation: Metrics like “Double Cake of Figs” and “Valuation” likely refer to assessment tools or methodologies to evaluate and ensure the sustained growth and stability of amassed wealth.

- Evolutionary Spectrum: The gradient from “LIGHT 0%” to more intense colors could represent stages of wealth maturity or the depth of integration of the Wealth Ecology Model.

Incorporation into Key Subjects:

Within the framework of the Wealth Ecology Model, your subjects of interest – Energy, Technology, Community, and Education – can be positioned as follows:

- Energy & Technology: These could be catalysts driving growth, potentially represented by the stages and checkpoints in the pathway. They would provide the means and methods to propel forward.

- Community: It resides within the micro and mesosystem layers, emphasizing collaboration, shared resources, and collective growth.

- Education: It could be a pervasive element, ensuring informed decisions at every stage, enhancing understanding, and fostering innovation.

Opinion:

The Wealth Ecology Model, as inferred from the diagrams, showcases a holistic, ecosystemic approach to wealth. It underscores that wealth isn’t just monetary; it’s about relationships, communities, values, and global perspectives. The journey towards sustainable wealth isn’t linear but dynamic, requiring continuous learning, adaptation, and balance.

Incorporating this model globally necessitates not just understanding the theory but also appreciating its practical, cultural, and regional nuances. It’s not a one-size-fits-all but a flexible model, adaptable to different contexts, ensuring that while the core tenets remain consistent, its application is tailored and relevant.

SourceEnergy Group R&D